by Christine Pervan | Jul 10, 2025 | Uncategorized

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a...

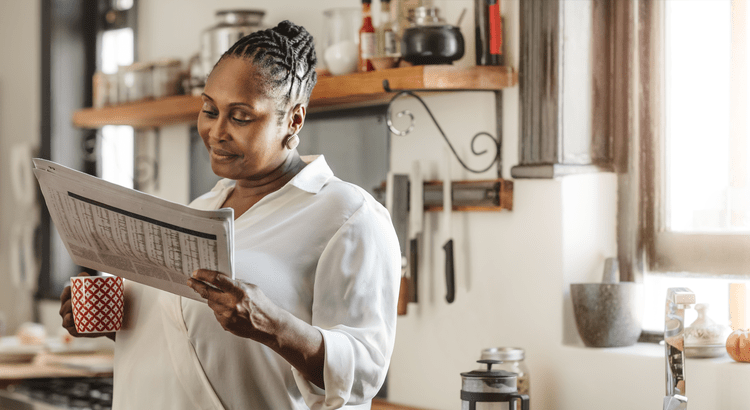

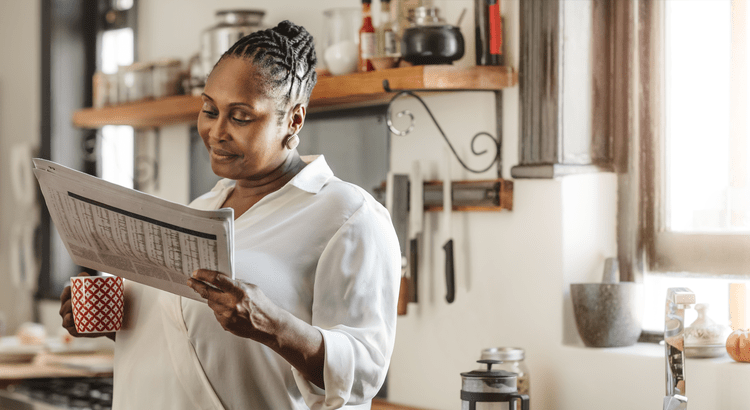

by Christine Pervan | Jul 9, 2025 | Uncategorized

If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:Is it better to start by finding your next home? Or should you sell your current house before you go out looking?...

by Christine Pervan | Jul 8, 2025 | Uncategorized

Some HighlightsNow that summer’s here, you may be planning your next getaway. But what if you didn’t have to? Buying a vacation home means having a built-in escape you can use year after year. It gives you the chance to generate rental income and have a go-to...

by Christine Pervan | Jul 7, 2025 | Uncategorized

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.Lenders are making it slightly easier for...

by Christine Pervan | Jul 3, 2025 | Uncategorized

If you’ve seen headlines saying home sales are down compared to last year, you might be thinking – is it even a good time to sell? Here’s the thing. Sure, the pace of the market has cooled compared to the frenzy we saw just a few years ago, but that’s not a red flag....

by Christine Pervan | Jul 2, 2025 | Uncategorized

Remember the chatter in the headlines about all the homes big institutional investors were buying? If you were thinking about buying a home yourself, you may have wondered how you’d ever be able to compete with that. Here’s the thing. That’s not the challenge so many...